Claims-Made Policy

What is a Claims-Made Policy?

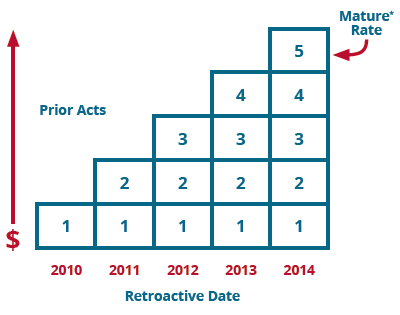

There are several policy types offered by medical malpractice insurance carriers – MedMal Direct Insurance Company offers Claims-Made coverage, the most common type of policy. This document will show you how the policy works to protect you and explains the stair-stepped pricing during the first four to six years.

How a Claims-Made Policy Works

As the name indicates, a Claims-Made policy will respond to “claims” that you report (“made”) during the policy period. In order to avoid overlapping coverage, the policy contains a Retroactive Date which establishes the initial point of coverage. The patient care that resulted in the claim must have happened on or after the Retroactive Date to be covered by your Claims-Made policy.

What is an Occurrence Policy

An Occurrence Policy differs from a Claims-Made Policy because an Occurrence Policy is a type of policy in which the insured is covered for any incident that occurs (or occurred) while the policy is (or was) in force, regardless of when the incident is reported or when it becomes a claim. Occurrence insurance for medical liability coverage is rarely offered today because of the difficulty in projecting long-term claims costs under this type of policy.

Claim Reporting Explained

A Claims-Made policy covers claims as long as they:

- Are reported during the policy period

- Are triggered by an event that occurred on or after the policy Retroactive Date (the first day your Claims-Made policy is active)

Example: You have a Claims-Made policy with MedMal Direct and a Retroactive Date from 2003. You submit a claim today for a patient you treated in 2004; your current policy would cover the claim.

Claims-Made policies provide coverage as long as they remain active or are renewed with the same Retroactive Date. Once the policy ends and is not replaced with a policy that carries forward the Retroactive Date (known as providing “Prior Acts”), the coverage stops for any claims that have not already been reported to the insurance company during the coverage period. MedMal Direct can provide Prior Acts for any new insured so you do not have to purchase expensive “Tail” coverage.

Coverage After the Policy Period

“Prior Acts” coverage allows you to transfer potential and unknown claims to your new insurance carrier. If you stop practicing medicine and/or stop renewing your Claims-Made policy, you will need an Extended Reporting Period Endorsement know as Tail coverage. MedMal Direct offers a free Tail endorsement when you retire, die or if you become disabled.

Claims-Made Policy Maturation

A Claims-Made policy has “stair-step” premium increases each year over the first few years.

Why the stair-step model?

These step-factors are actuarially determined based on the probability of a lawsuit being filed against the insured physician during those initial years of coverage. A first year Claims-Made policy only covers the professional services you provided during a single year. Therefore, the premium is substantially discounted. In the second year, you have effectively doubled the number of years covered, so you can expect your premium to double. When renewing to a third year, the exposure increases by another third and so will the premium and so on, until the policy matures. Changes in state-filed rates, claims, group changes and other factors can

still affect your premium.

*After four to six years, depending on your location, your premium is considered “mature” since at that point almost all claims will have been reported and your premium will level off.